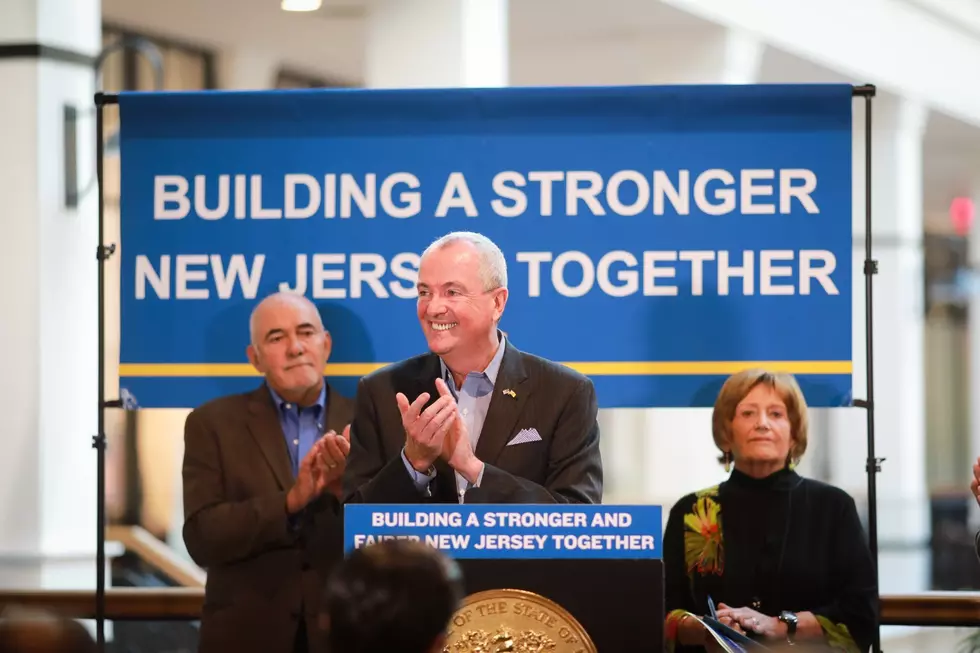

Murphy orders plan for public bank, calling it ‘a force for good’

Two years after his election, Gov. Phil Murphy is finally taking a first step toward fulfilling one of his more unique campaign promises: the establishment of a state-owned public bank.

Murphy signed an executive order Wednesday in Newark that creates a 14-member board, made up mostly of administration officials, which will have a year to develop an implementation plan.

The Public Bank Implementation Board will assess capital needs for small businesses, students, local infrastructure and affordable housing projects, with a special emphasis on supporting low-income and minority populations not fully served by existing financial institutions.

“The public bank was, to be sure, one of the first major policy proposals I unveiled, and I have been anxious to make progress on it. And now we will,” Murphy said. “I still believe in the ability of a public bank owned by the people of New Jersey to be a force for good.”

North Dakota has the only public bank currently, though a new law allows them in California.

Phyllis Salowe-Kaye, executive director of New Jersey Citizen Action, who has been talking up the concept of a public bank with friends since the 1970s, said the executive order marks a historic day – but like all who spoke, that the path toward implementation will be difficult.

“Don’t kid yourself. This is really hard stuff that we’re about to do. None of us who believe in this effort think that this is going to be an easy job.”

Patrick Morrissy, vice chair of New Jersey Community Capital, called the prospect of a New Jersey public bank “the boldest stroke yet” for community redevelopment.

“And we know the road ahead is complicated to say the least – technically, financially, perhaps politically,” Morrissy said.

State Sen. Anthony Bucco, R-Morris, called the idea “a looming catastrophe” for taxpayers because of the potential risk of defaults on loans that wouldn’t be federally insured by the Federal Deposit Insurance Corporation, the FDIC.

“Gov. Murphy needs to focus on New Jersey’s high property taxes and underfunded schools, rather than launch this bottomless money pit that will no doubt be run by politically connected folks,” Bucco said.

The idea hasn’t gotten much support among Democrats who run the Legislature, either. Murphy said it has taken a little longer than expected to get the public bank going.

“The concept here is actually quite a simple one. Turns out executing it is harder than we’d like,” said Murphy.

Backers of a public bank say it could provide below-market rate capital for creditworthy, socially beneficial projects. Murphy said public funds are used now by financial institutions to invest in such projects – but that they’re often overseas, when big banks are involved.

Sean Spiller, vice president of the New Jersey Education Association, one of four public members on the implementation board, said a public bank can put its money toward small businesses and fairer student loans.

“When we’re investing in the people of New Jersey, that is what we should be doing. Putting our dollars to work for Main Street and not for corporate Wall Street,” Spiller said.

Republicans criticized Murphy because one of the 10 administration officials he appointed, Derrick Green, a senior advisor to Murphy for diversity and urban affairs, had been tied to a $350,000 campaign finance scandal as a political consultant in Bermuda. Green has not been charged.

“Gov. Murphy is once again intentionally ignoring significant issues involving someone within his administration, and doing so conspicuously,” said Assemblywoman Holly Schepisi, R-Bergen.

More From WOBM News:

More From Beach Radio