Three Jersey Shore, NJ Towns Make List Of Lowest Property Taxes In New Jersey

One word people in New Jersey know all too well: taxes.

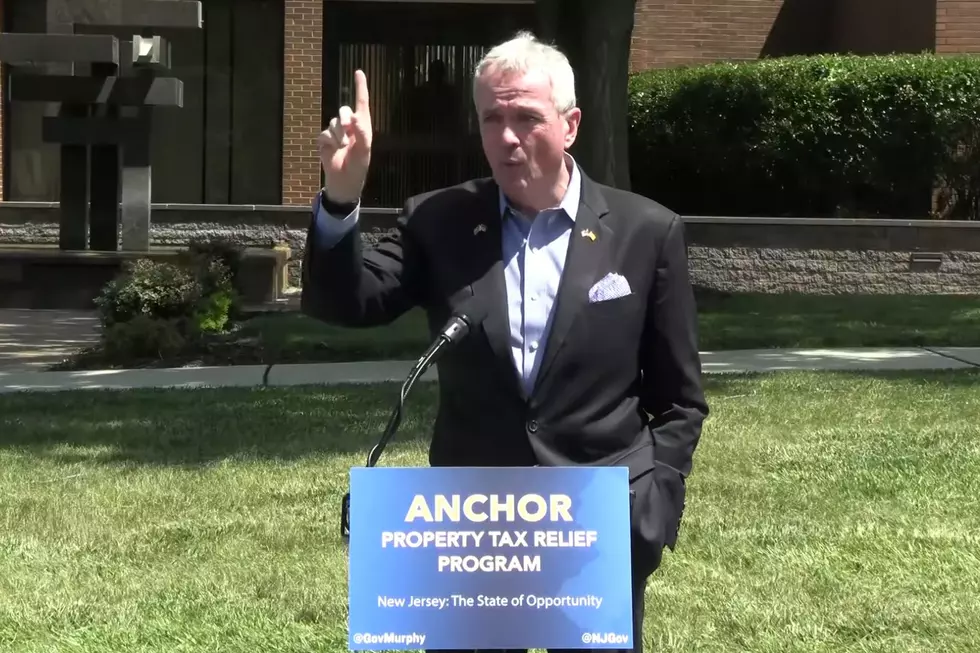

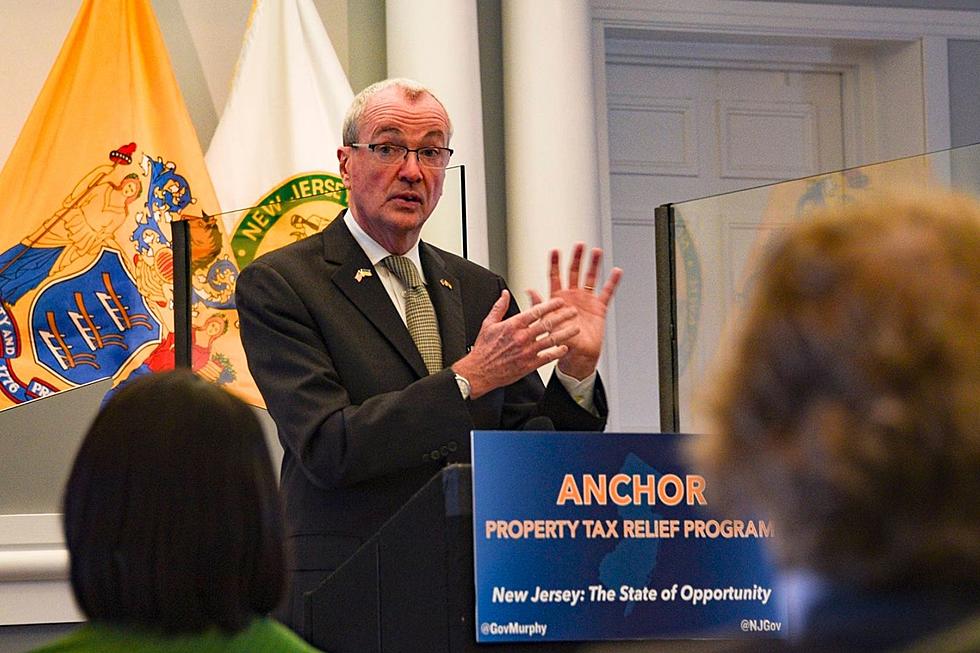

You heard it from Governor Phil Murphy first:

“If taxes are your issue, then New Jersey’s probably not your state.”

Daaaangggg, Murphy! Harsh much?

We are all used to having to cope with a more expensive lifestyle because the cost of living in New Jersey is so high.

If you want to scare yourself before we look at the cheaper end of things, take a look at which Monmouth & Ocean County towns have the highest property taxes.

FYI: These numbers are not for weak stomachs.

But I am also here to give you some information on the other end of the spectrum.

According to MSN.com, there are only three Jersey Shore towns who made the list of the Top 30 towns in New Jersey with the cheapest property taxes.

If I am being honest....that is more than I thought there would be.

This is tourist central and real estate located near any body of water is not a cheap amenity.

BUT....Jersey Shore towns did not even crack the Top 10! Shocker....but not really!

The county who got the most cities on this list will surprise you and is a bit confusing...but more on this in a second....

Let's take a look. Do any of these results surprise you?

Three Jersey Shore Towns Make List Of Lowest Property Taxes In New Jersey

Do these results surprise you?

All I am saying is that if you are looking to buy a home with affordability in mind, the Jersey Shore might be a bit tougher.

The county with the most cities on this list is....Cape May County with a total of 6!

Here is why I am confused.

Cape May is right along the coast of New Jersey and along the coast/waterline is an expensive place to be.

So how on earth are they the cheapest when both Cape May County and the Jersey Shore are known or beaches, tourists and boardwalks?!

I guess it all has to do with New York City. They do say the farther south you go, the cheaper the cost of living.

So down to Cape May County we go!

If you want to choose where to live based on other factors, here are some suggestions:

LOOK: Here are the 25 best places to live in New Jersey

What's Your Jersey Shore Zodiac Sign?

More From Beach Radio