Did State of New Jersey use the wrong data in school aid calculations?

There's a possibility that the state of New Jersey used the wrong data in their school aid calculations.

David Sciarra, executive director of the Education Law Center told the Gannett Trenton Bureau that the state used the wrong tax year to calculate school aid.

The state used 2018 tax data, not 2019, which could affect 194 school districts that would lose aid.

“These are districts that may be exempt from cuts, or have their cuts reduced, as a result of using the most current data," Sciarra told the Gannett Trenton Bureau/northjersey.com. “We don’t know, we’re not sure, because we don’t have the data we need to make that determination. But it could turn out there’s relief from these cuts for some of these districts that stepped up to the plate and increased their property taxes for schools.”

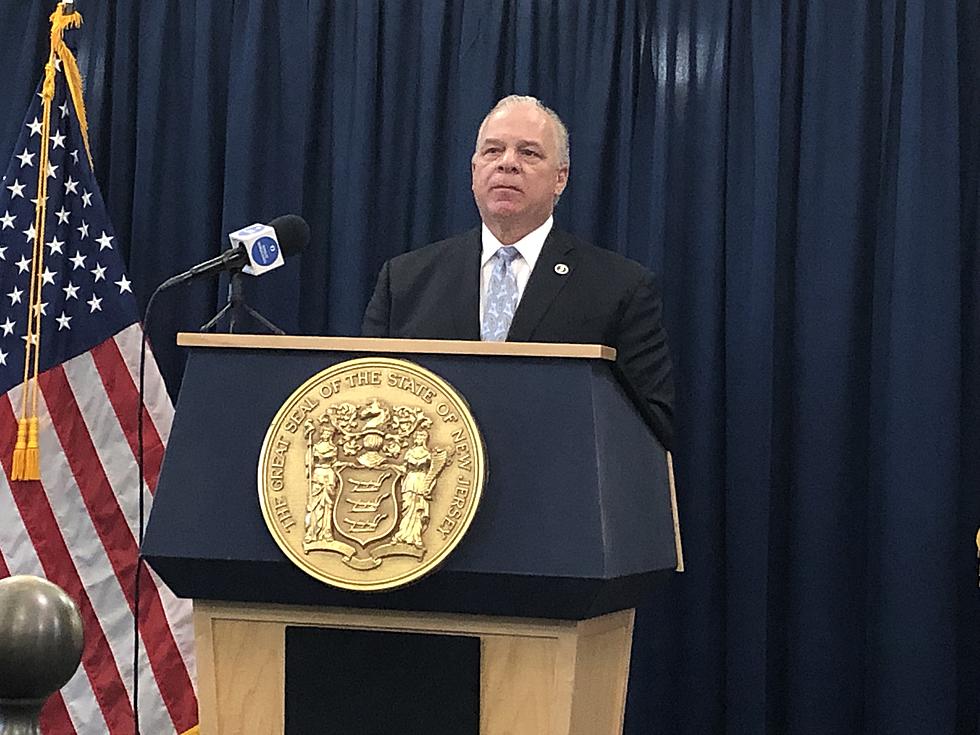

On Wednesday morning, New Jersey Department of Education Commissioner Lamont Repollet issued a statement with an explanation of the school aid formula following today's State Board of Education meeting that was held in Trenton.

The issue at large is Governor Phil Murphy's proposed FY21 State Aid for school districts.

“As many of you might know, amendments to the SFRA include exemptions from the state aid reductions for districts based on each district’s equalized total tax rate compared to the statewide average," Repollet said. "State law requires us to use tax data for the most recently available calendar year to determine eligibility for these reductions. Determining whether a district is eligible for these exemptions is the only effect that local tax effort has on a district’s proposed state aid allocation under SFRA."

Governor Murphy delivered his budget message nearly a week and a half ago and the results were praised by many but there are 194 school districts feeling the sting of budget cuts as a result of the aid being cut.

Repollet explained that yes they did use the 2018 tax rate data instead of the 2019 tax rate data to calculate school aid but it was because it was the most recent available calendar year.

"In order to meet our legal obligation to provide school districts with proposed state aid notices within two days of the governor’s budget message, we utilized 2018 tax rate data," Repollet said. "However, the 2019 tax rate data has now been finalized and will soon be published by the DCA."

He said that in the coming days, the DOE will provide all school districts with updated state aid notices based on the 2019 tax data.

Although, Repollet explained that the only district that’s projected state aid notice will be impacted by this revision will be the Pemberton Township School District in Burlington County.

As a result of the recalculation, Pemberton’s projected FY21 state aid will total $75,493,632, an increase of $2,028,552 compared to the February 27, 2020 State aid notice.

With Pemberton being the only school district who will see changes, that means the other districts who received news of gains in aid or a cut in aid to their budgets, things will remain the status quo which doesn't bode well for districts like Toms River who is losing $5.3-million this year and Brick who is losing $4.2-million.

More Jersey Shore News:

More From Beach Radio